We have talked about the pros and cons of currency trading before. This post is basically a follow up for those who want to dig deeper and earn some money on the side.

Let’s assume you have been reading this blog for a while and you’ve decided to invest your money in the world’s largest financial market: the forex market. You know how it works, theoretically, but how to put that knowledge into practice? Read on, it’s actually not that difficult, but you need to have a strategy.

Step 1: Choose a broker

If you are starting from scratch, wading into the currency market, the first thing you’ll have to do is to choose the right broker. Having a professional broker on your side is crucial for several reasons:

First, you want legal security. Therefore, you need to choose a broker that is regulated at least in one or two major countries. Hence, in the event of bankruptcy, you will have a jurisdiction to appeal to. You might not think about that when you are just starting out, but believe me, it’s good to have legal security.

Second, you want a broker that has enough resources to make sure that the trading platforms you use are stable and reliable. You don’t want your platform to crash every single time the market becomes a bit more heated.

Third, choose a broker with good customer service. You might want to place a trade over phone once in a while and you will occasionally need technical support for your trading platform. Good customer service can be worth a lot if you need it, and you want to make sure that you get the best possible support. That’s especially crucial as you are a beginner. Good forex brokers guide their traders and having an expert on your side will give you more confidence.

Step 2: Open a demo account

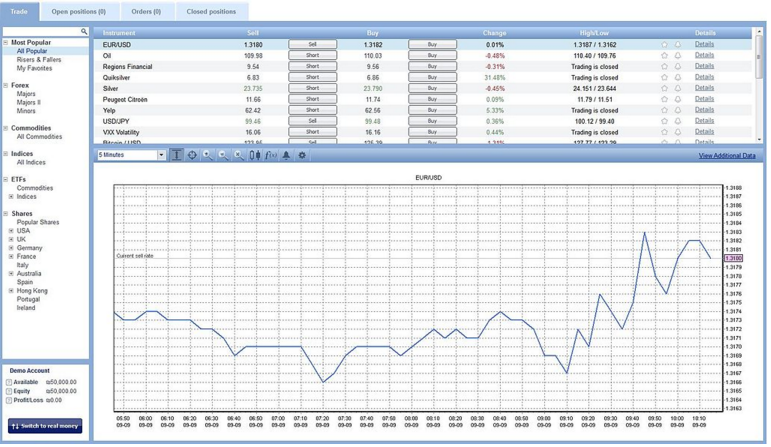

Once you have selected your broker, it’s time to test drive the software. As a pure beginner, you don’t want to trade with real money until you really know what you are doing. A demo account is like playing a friendly match. You will gain practical experience but it won’t matter if you lose.

Most brokers’ demo accounts offer exactly the same functionalities as live accounts, even prices are real-time market prices. However, the money is not real and that offers you the opportunity to learn how to trade and how to use the platform. If you don’t get along with it, don’t hesitate to switch to another platform.

Step 3: Create your own trading plan

Before things get real, you need a strategy. Hence, do your homework and learn how to justify your trades through research. Remember, the forex market is primarily a technically driven market, so you should know how to perform an in-depth technical analysis.

The best places to find information are the internet and the major newspapers. Moreover, it won’t harm to read a book on technical analysis. Once you understand the principles of forex trading and you have a strategy in your head, you should put it on paper. That’s what traders call a “trading plan.”

Step 4: Open a live account and start trading

Once you’ve created your personal trading plan and tested it with your demo account, it’s time to start the real adventure. Open a margin account and start trading with real money.

In the beginning, don’t use high leverage and don’t invest large sums. Most brokers will provide leverage of 50:1 or 100:1. If you trade less than $50.000, you can even get a leverage of 200:1. Take it easy in the beginning.

Go slow! You can still boost your investments once you have more confidence. Also, stick to your trading plan and improve it continuously. Many traders have a trading plan, but they never look at it. That’s like driving a car without looking at the map. You might reach your goal, but the map will increase your chances.

It will be exciting, especially in the beginning. Don’t get overwhelmed. Instead, take your time to get acquainted. After a while, trading will become part of your daily routine and hopefully, it will add to your monthly income. Good luck and feel free to share your experience in the comments box below.