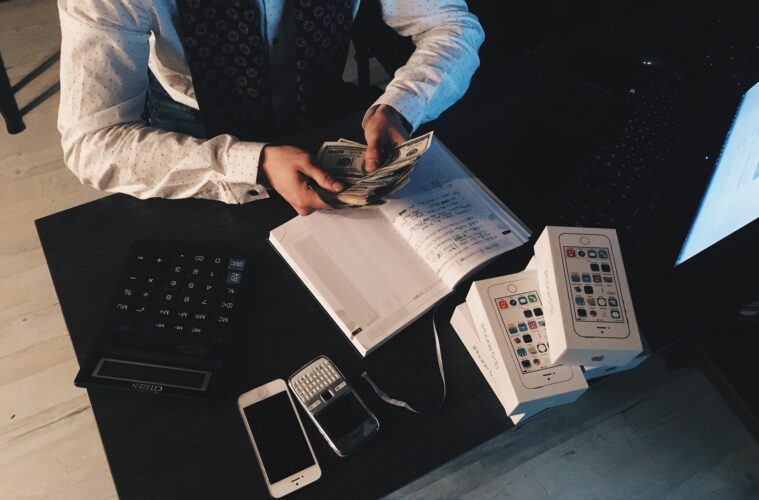

You should be seeking to get your financials in order while starting your firm to provide you with the solid foundation required to launch your company. Using the services of a skilled accountant might put you in the best possible position for future growth and development.

Why Outsource Your Accounting?

Despite the economic downturn and recession, there are still many business possibilities for nimble, innovative entrepreneurs. Certain industries will have to change to meet demand, but they will also require new technologies to adjust to it.

As a result, for many technology-based businesses, growth is still rapid, and competition is fierce. However, where start-ups do have quicker development, they may discover that certain business fundamentals such as accounting have not been addressed in time.

Knowing when to outsource certain essentials is an essential component of company strategy. To ensure that you don’t lose control of the elements that help your business run, you must know when to outsource them.

Several significant advantages can be gained by hiring a professional accountant such as Lalea & Black CPA firm or a similar accountancy firm in your area, to assist you with your books. These include:

- Expertise with accounting and bookkeeping

- Financial advising

- Audit trail

- The ability to make educated judgments about what will sell and what will not.

- Accounts accessible only by a single user

If you’re worried about accounting regulations, realize that the core function of your business may fall outside of its scope. If you want to keep your start-up firm on track, make sure it has strong accounting and bookkeeping capabilities.

A competent accounting firm, like Venn Accounts, may assist you in putting up essential financial systems for your company.

An accountant can identify issues in advance, such as cash flow roadblocks, and take action before they have an impact on your balance sheet.

Another crucial component of operating your firm is tax compliance. Compliance and regulatory concerns might be difficult, so an accountant can help you navigate them while also ensuring that you receive everything you’re owed.

An accountant might perform an audit of numerous elements of your company, such as your suppliers and costs, to ensure you’re financially ready for investment if you want to secure finance or a loan.

Finally, the advantages of working with your accountant aren’t restricted to accounting concerns. Accountants provide a wide range of business knowledge and insight that you may use.

Your accountant can also support you as a strategic business adviser.

Does Your Business Need an Accountant?

There is no law banning you from keeping track of your finances. Businesses don’t need to engage the services of a professional accountant. An accountant, on the other hand, is an accessible resource that may add value to your company. Your accountant can mostly handle your self-assessment or end-of-year reports at a basic level.

These are all important administrative activities that any growing business must complete to some degree. Most start-ups begin modestly, usually with a few individuals in a room, but as they develop, so do their administrative needs.

The most important thing to remember is that when these criteria imply you may benefit from outsourcing specialist areas such as your accounting, it pays to keep an eye out for them. Remember, too, that you can claim your accountant’s services as a business expense to lower your taxes.

Is Using an Accountant Costly?

Having an accountant, you can turn to as a resource, on the other hand, is quite cost-effective.

They are someone you can put in a position of confidence since they get a thorough knowledge of your organization, assisting to prepare it for growth while also working to minimize your tax burden. When you’re a start-up, trust is a valuable commodity, and it may be the difference between success and failure.

How Do You Choose an Accountant for Your Start-up?

When it comes to choosing a small company accountant, you’ll want someone who is familiar with your type of business and can also meet your unique demands.

If you’re a technology start-up, for example, you’ll want to find an accounting firm with sector expertise. You should also look for someone who can provide personal contact and transparency so that you know exactly who you’re always dealing with.

This aids in the development of important confidence in working with an outsourced accounting firm.

The following are some of the most important points to consider:

- Certification and membership in organizations

- They have a large range of services, including essentials such as accounting software.

- Customer service level

- Fees

- Who will you be communicating with daily?

- How many clients does the accounting firm have?

Making the most of having an accountant to help your company entails developing and nurturing a positive working relationship with them. Making frequent contact and keeping your finances organized are two ways to do this. It allows your accountant to assist you.

SMEs generally require less accounting help than corporations, but it’s always worth checking out the service you’re receiving regularly. Take advantage of the services and knowledge that will help your company succeed by maximizing what your accountant can do for you.

Why Use Venn Accounts?

Venn Accounts offers a variety of specialist, cloud-based accounting services to small businesses in the United Kingdom. Contact them today to learn more.