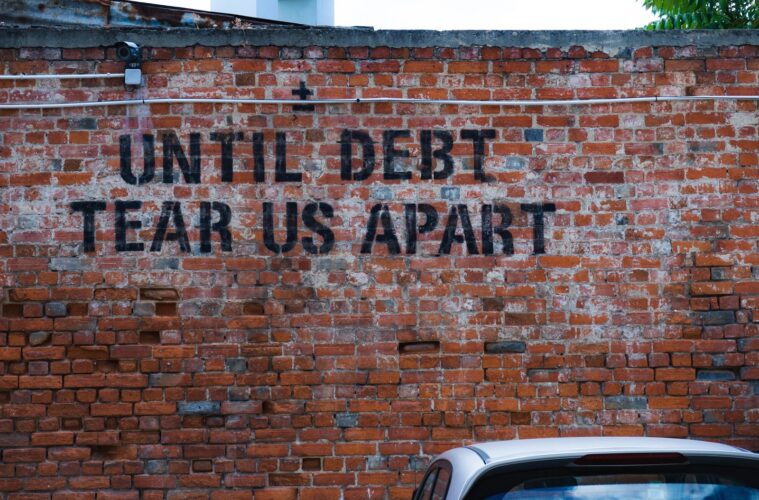

Photo: Ehud Neuhaus/Unsplash

Does your debt-to-income ratio seem more debt than income? Do you find it difficult to make it from payday to payday without running out of money? If so, it’s likely your debt has gotten out of control and it’s time to do something about it.

If you have too many credit cards or an emergency of some kind has taken every last penny you had, the financing tips below can help you get out of debt.

1. Get a Loan

Obtaining a loan isn’t an ideal solution for everyone, but it’s a quick way to solve money issues that pop up suddenly. For example, if your car needs expensive repairs, a no-interest loan scheme enables you to get the repairs done right away and then lets you pay back the loan with no interest if you get it done in a specified amount of time. In many cases, you don’t need to have excellent credit to obtain a loan like this, so don’t automatically assume you won’t qualify if your credit rating isn’t perfect.

2. Create a Budget

This do-it-yourself approach requires discipline and a strong will. You will need to analyze your finances, create a budget, and then stick to it. Depending on what you find during your analysis, you may also need to get a second job and cut expenses where you can to free up money to pay off your debt.

When you decide to begin eliminating your debt, you’ll need to contact your creditors to work out payment plans. Some creditors will be willing to work with you while others will not. Before you commit to going it alone, you must decide if you have the patience and temperament to conduct time-consuming and difficult negotiations with your creditors yourself.

3. Join a Debt Management Program

Debt management programs, run by credit counseling services, can help you pay off debt through a structured program and monthly payments. A credit counselor will negotiate with your creditors on your behalf for lower interest rates and a reasonable payment plan. You’ll then make a monthly payment to the counseling agency so they can pay your creditors for you. You’ll also receive financial education, advice, and motivation to help you stick with the program until your debt is paid off.

4. Consolidate Your Debt

When you consolidate your debt, you take all your outstanding credit card balances and your mortgage payment and combine them into one larger loan that usually has a lower interest rate. Many people use their homes as collateral, which means you need to make your payments on time or risk losing your home.

Consolidating your debt helps you save money on interest as most credit cards have extremely high rates. That said, if you’re the type to carry high balances on your credit cards, it won’t fix the underlying spending issues you may have.

5. Bankruptcy

Bankruptcy should not be considered an easy way to get out of debt. It’s a last-resort method that negatively impacts your ability to obtain or use credit for a long time afterward as it stays on your credit report for up to 10 years.

There are two types of bankruptcy in the US: Chapter 7 and Chapter 13. It’s extremely important to understand the difference between the two if you think bankruptcy is your only option for getting out of debt.

The key to avoiding or getting out of debt is to find the right solution for you. You have options, with the suggestions above being just a few. Don’t panic if your debt gets out of hand. Just commit to finding a solution and stick with it!