Investment diversification almost always gets sold to us as buying up enough various stocks that if one of them takes a plunge, the relative stability of the others will lead you calmly through the storm to riches and satisfaction and happy living. And for some people, in some eras, this was true. This understanding of diversification is central to the success of financial products like ETFs and mutual funds, just like any personal finance blog would tell you. The problem is, investment strategies which rely solely on ETFs and mutual funds only work when the markets are up. What happens when to your retirement account when the markets suddenly fall, right before you need to start your retirement? Just ask the thousands of Americans who saw everything they had earned disappear during the financial crisis of 2008! No amount of stock diversification would have prevented their problem. What is necessary is diversification across investment forms. This is where Forex comes into the picture.

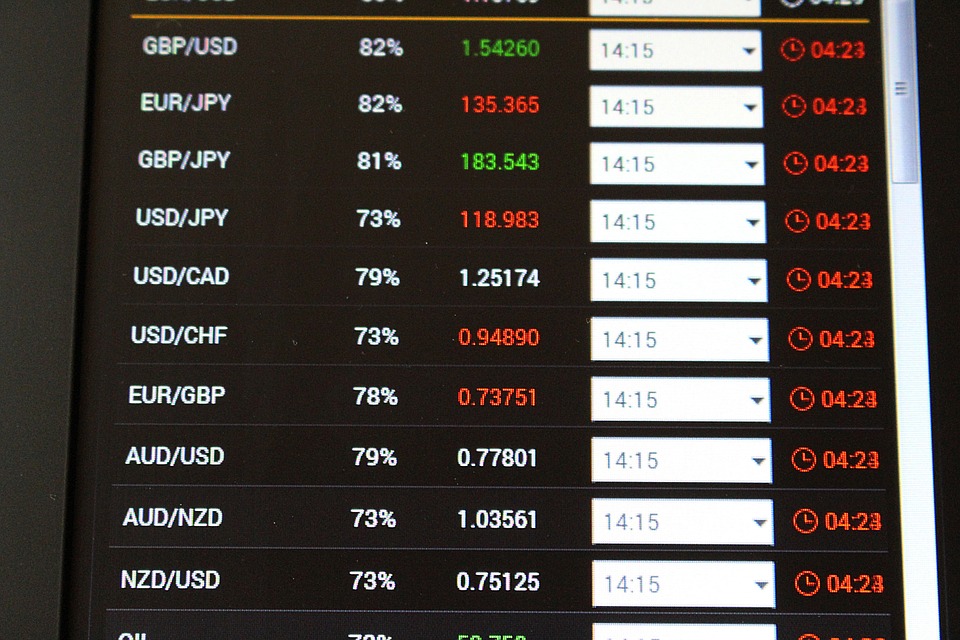

Forex, and its frequent companion spread betting, is made available through online platforms like ETX Forex Trading. Forex allows users to trade against the value of currencies, just as spread betting allows users to trade against the values of commodities and indices. Notice that I said trade against, not trade on. With Forex trading, in the sense usually used to describe popular web and mobile platforms, the investor isn’t actually buying and selling currencies. Rather, that investor is trading against the changes in value of currency pairs, according to the accuracy with which the investor can anticipate these changes.

There’s a little more to it than than, but what I hope you can appreciate is that Forex is different than stock market trading, because it is not about ownership. With stocks, you own a piece of a company. If that company tanks, so do the value of your stocks. With Forex, the user doesn’t care whether or not the value of the Australian Dollar plunges into oblivion. The user only cares if he or she anticipated that kind of value change, and invested accordingly. The same general rules of buy-low-sell-high apply to Forex and stock trading all the same, but with Forex, you’re not actually “buying” anything, unless you think of it as buying the right to collect dividends based on the accuracy of your predictions. I’ll leave it to you to learn the details of Forex trading on your own.

For our purposes, it’s enough to understand that Forex trading, alongside traditional investment, is a way of diversifying against the risks inherent in both forms. If one method fails your strategy, as will sometimes happen no matter what forms of investment you choose to take part in, the other is unlikely to fail at that precise moment. These are not the only two kinds of investment you may take part in. This serves as an illustration. Good investors put their money into systems that are independent of one another, as a way of not putting “all of your eggs in one basket”.