Recently, Adidas decided to end its relationship with Kanye West over his antisemitic remarks, and to stop making any products under the Yeezy brand and paying West and his companies.This comes after West, now officially known as Ye, was suspended from Twitter and Instagram over his antisemitic remarks. One unintended consequence of this decision will be to make Yeezy-branded sneakers so much more valuable, boosting the sneaker reseller market.

Supply and Demand

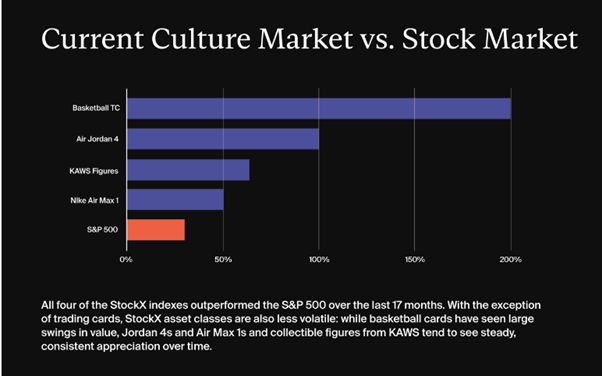

A report by StockX last year found that 37% of limited-edition sneaker buyers were motivated by their investment potential. Meanwhile, 48% of collectibles buyers were motivated by their potential future value, or investment potential. The culture market has delivered impressive returns for these investors. Between January 2020 and April 2021, the typical Jordan 4 investor earned a 100% return on their portfolio. In that time, an Air Max 1 investor earned a 50% return, a KAWS figure investor earned a 65% return, and a PSA 10 basketball card investor earned a 200% return.

Source: StockX

These culture market products are only examples of a wider trend in which culture market products have outperformed the stock market. Owners of sneakers such as Nike Dunk shoes, for example, have also enjoyed strong returns in recent years. The question for many sneakerheads and sneaker investors is, why have sneakers become such a great investment?

Driving these returns has been the most powerful force in the market: supply. The culture market has done so well because the supply of these items has been constant. Meanwhile, the demand for those items has shot up at a time when disposable income has been growing. Constant supply with exploding demand can lead to incredible rates of return.

The effect of Adidas’ decision is to permanently limit the supply of Yeezy sneakers. Anyone who wants a Yeezy sneaker will have to turn to the sneaker reseller market. You will not be able to get them from Adidas. Supply drives future returns, and investors in sneakers will know that with limited and declining supply, the value of the Yeezy brand on the reseller market will explode.

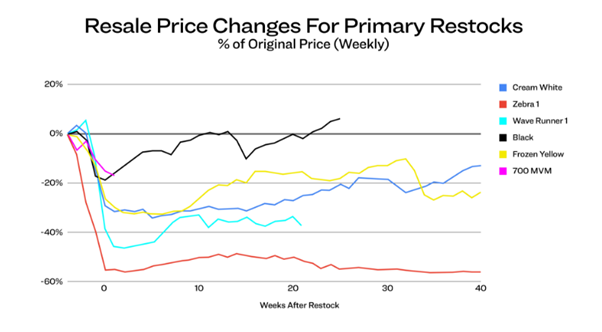

This is especially important given that Yeezy branded sneakers have experienced declining returns since West launched Yeezy Supply and started producing millions of sneakers. StockX’ research shows that resale prices of Yeezy sneakers have typically declined four weeks prior to a primary restock on Yeezy Supply.

Source: StockX

There is no evidence that demand for the Yeezy brand had declined as a result of West’`s remarks or opinions. Indeed, Adidas itself admitted that it will lose $250 million this year alone, as a result of its decision. With supply being cut off, and demand likely to remain strong, there will be upward pressure on the price of Yeezy sneakers, and their price volatility will smooth out.

While not every Yeezy sneaker will experience market-beating returns, it is true that the price of the average Yeezy sneaker will take off, simply because of what Adidas’ decision means for supply. Traditionally, Nike Air Jordans have been the best brand to buy for sneaker investors, but Adidas Yeezy sneakers may just be the next great sneaker investment.