The United States is one of only two countries in the world that taxes citizens regardless of where they’re living. Unfortunately, it can be difficult to find qualified help locally, and we all know that you don’t want to get on Uncle Sam’s bad side.

This is where Taxes for Expats can help. You benefit from expert human help who have at least 10 years of experience in the industry. More than 50% of staff have more than 20 years of experience under their belts. No work is outsourced to any third parties, so you can be certain that your taxes are being handled by US citizens working directly for Taxes for Expats.

This is also a super secure option. At least two tax professionals will check your return, ensuring that even the simplest (and most complex) issues are inspected, and the best solutions found for your unique situation.

You also don’t need to worry about your budget, with the fair upfront pricing which ensures that you’re not dealing with any sudden surprises. Fees are flat and transparent, and you can see at a glance how much you’ll be charged.

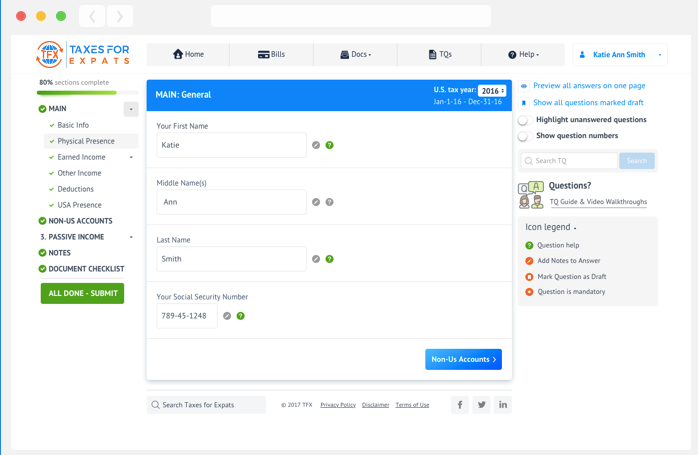

The system itself is super user-friendly, with a hard-working client portal which will surprise you with just how easy it is to navigate.

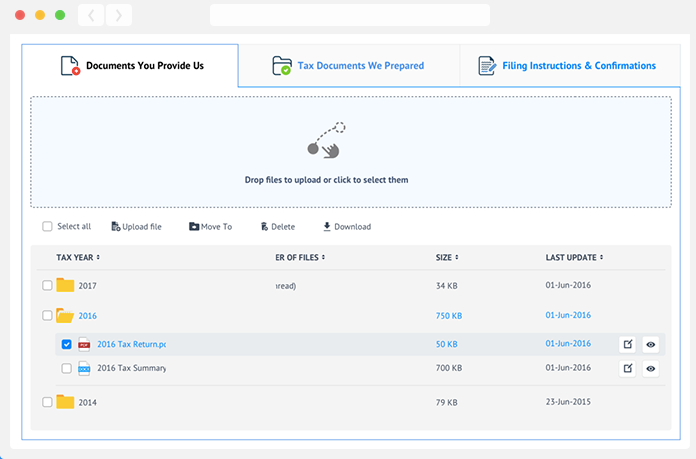

Taxes for Expats doesn’t store any of your data with third parties- even trusted ones like Sharefile or Dropbox. The company takes complete responsibility for your information.

The questionnaire is also easy to use, with no PDFs, Word files, or Excel spreadsheets to keep you up late at night. The team has worked hard to make it as easy as possible for you to get the job done in the shortest amount of time.

Another one of the standout features? The 18-hour support. They even have live chat support, so you don’t have to talk on the phone if you don’t want to. This top-rated firm can help you with the review of the Taxes For Expats (TFX) in case you still have questions about expat taxes.

The process is super simple, and you’ll simply register and schedule a free 30-minute introductory phone consultation. Once this is finished, you’ll complete a tax questionnaire and sign an electronic engagement letter. Then you just need to sit back and relax while the hard-working team do your taxes for you. Once this is done, you’ll pay and review your return. You can find more information on how to file US Tax from abroad here.

Thanks to the usability, security, customer service, and fair pricing, Taxes for Expats is a great choice. So if you’re living overseas and wondering how you’ll file your taxes, this may be the answer you’re looking for.