Technological advancement has brought with it a lot of mind-boggling innovations that have literary disrupted the way we invest and grow our wealth today. The advent of online trading was premised on the developments made on internet connectivity across the world and the creation of supercomputers that are able to process lots of data in a fraction of a second; as well as improvement in cybersecurity. With the increasing research into machine learning and artificial intelligence, online trading companies are revolutionizing trading in financial markets in the 21st century.

In the past decades, trading in financial markets was an exclusive venture for the wealthy and their finance nerds who would help them in analyzing the market trends and in cracking hard financial models before making their investment decisions. Today, super computers interconnected globally are able to collect data from different sources, analyze it for you, and then provide you with insights for investment decision-making. You do not have to be a finance expert to get started in online trading since much of the data collecting and analysis is done by the online trading brokers on their online platforms; all you need is to open an account, get oriented into the online trading environment and then start trading as you improve on your skills over time.

- Getting the right online trading broker

Choosing an online trading broker who is most suitable for you then becomes a very critical decision for a newbie. You need to be assured that your online trading broker is a reliable one with security systems that will not compromise your personal and financial data. As a beginner, you will also need to get a lot of hand-holding on your initial trading day and as such you need a broker who has training materials for beginners and other online support when making your first trading decisions. Understanding market dynamics is also very important in your day-to-day trading. Hence you will need to get a broker such as Stern Options who provides you with regular market updates on their online platforms and reaches out on social media too with daily market reviews via their Facebook page.

- Choosing the suitable online trading underlying assets

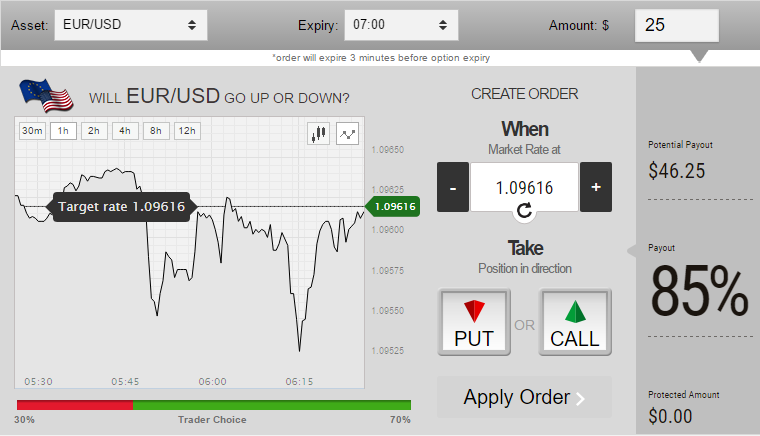

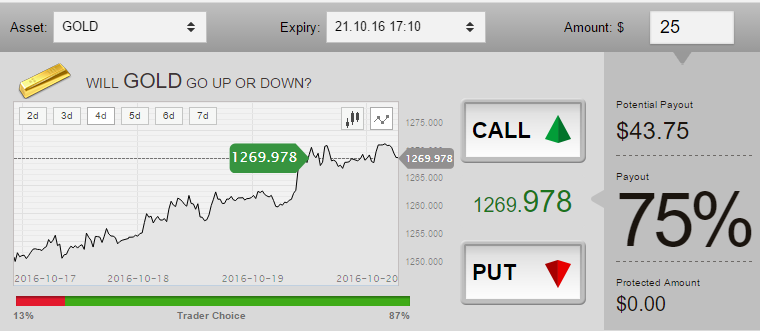

The decision on which online trading broker you will go for is tied to another decision on which assets you are interested in trading on. Different online trading brokers have varying ranges of underlying assets that they provide to their traders to trade on; based on their market knowledge and capacity. When you sign up with Stern Options, you will have the opportunity to choose from four major categories of assets which include currencies, commodities, stocks, and indices. This comprehensive list of asset classes gives you an array of options beneath each one of them that you can choose from and create a portfolio mix that minimizes your risk while increasing your cumulative potential returns.

For instance, under the asset class of stocks, you can choose to trade on one of the biggest companies in the world such as Google or Apple. If you decide to trade on currencies, you are then exposed to different currency pairs for all global leading currencies including the US dollar, the euro, the British sterling pound, and the Japanese yen among others. Under commodities, you are provided with a wide range of options starting with precious metals such as gold and silver and extending to minerals such as oil; as well as including cereals such as wheat. You can also opt to trade on indices where you will be at liberty to choose from leading global indices such as S&P 500, NYSE Composite Index, and NIKKEI among others.

- Getting it right in trading

It is therefore apparent that the traditionally exclusive industry meant only for the well-to-do in the society has been opened up to the public to participate in it from the comfort of their homes. For example, many people are wanting to know jak zacząć grać na giełdzie (how to start playing the stock market) and therefore research the relative articles to educate themselves. This has led to thousands of people joining online trading platforms from different parts of the world in order to get a piece of the pie. With more people getting on board, you will therefore need to sharpen your skills in order to survive within the competitive environment. Studying the markets yourself will come in handy as well as understanding how to differentiate between market information and noise.

Filtering through the market noise to get relevant data and interpreting it correctly on the implication it will have in the market and the resulting market price of your underlying asset is the key to becoming a veteran in online trading. Building this skill takes a lot of time, but thankfully leading online trading brokers such as Stern Options to have back-up market trends analysis that will guide you through in your trading decision making as you learn how to it yourself.