Just how many investors take this usual line from a mutual fund’s disclaimer seriously? “Past performance is not necessarily indicative of future results.”

Most investors don’t take this seriously mainly because they feel this is just a disclaimer that funds use to protect themselves legally. However, going by a recent McKinsey Global Institute study, investors need to take this message more seriously.

At its core, this message is targeted to make investors lower their expectations, so as not to take unnecessary risks, thinking they are going to replicate the success of the past in their investments. But it’s understandable that investors haven’t been taking this message seriously.

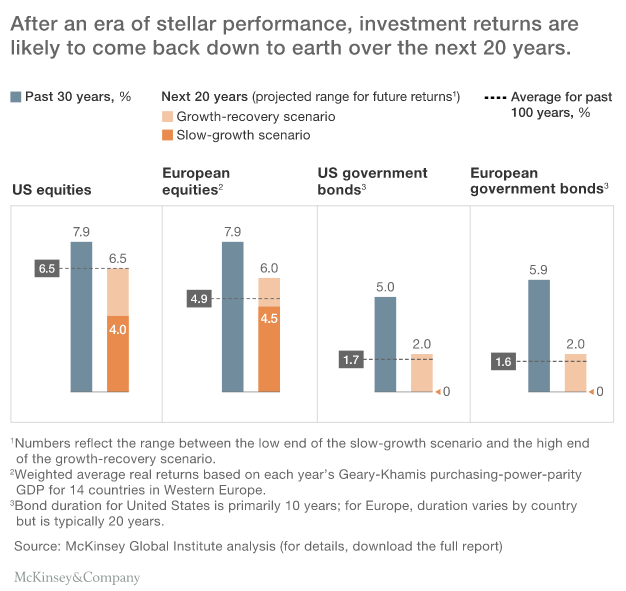

As the image above shows, US equities over the last 30 years have retuned about 7.9%, compared to the 100-year average of 6.5%. European equities have also returned 7.9% over the last thirty years, compared to the 100-year average of 4.9%. Buoyed by high interest rate environments, bonds have performed significantly better, with US bonds returning a stellar 5% vs. the 100-year average of 1.7%. European bonds, on the other hand, have seen a return of 5.9% vs. the 100-year average of 1.6%.

With such a performance that beats history, it’s not exactly out of place that investors don’t take this seriously.

However, again, as the image shows, the next two decades could see returns on each of these fronts drop significantly – below their respective 100-year averages, in some cases.

According to McKinsey, the upcoming era of diminished returns is mainly because factors that fueled the impressive returns over the last three decades, including low inflation and interest rates, rapid GDP growth, buoyed by productivity gains and stellar corporate profits, are gradually headed in different direction.

I’ll be the first to admit. Forecasts don’t always turn out to be the reality. The only sure thing about the future is that it is unpredictable. However, since we’ve seen some predictions become reality in the past, it could be worth it for people with any amount of stake in the financial markets to adjust accordingly.

That said, here are the three set of people who will able to withstand the outcomes of a diminished-return environment.

Stock pickers

Actually, the term stock picker doesn’t accurately define the point here. For the purpose of this article, a stock picker would be someone who is able to identify investment opportunities that will perform.

“Since McKinsey’s study has found that returns over the next two decades will be below what we’ve seen in the last three decades, you cannot afford to place your money on just about anything you hear is hot at the moment,” according to Joshua Foster, chief analyst at Morton Finance. “In such a period it will be difficult to find growth everywhere you turn,”

However, there are definitely asset classes that will perform impressively amid the depressed-return environment. So to get growth in a diminished-return environment, you need to learn how to identify growth opportunities and invest accordingly.

People who save and invest more

If McKinsey turns out to have gotten any part of the forecast correctly, then the law of number will become important. Because if you can’t expect to get historical returns for the amount you currently invest, investing more will help you grow your portfolio. Of course, that may not come at the same rate as we’ve seen in recent history.

However, if you’re not ready to modify your investing principle to only focus on growth opportunities, which is a great thing, you need to start saving and investing more. The only thing is that by doing this, you need to be strictly long-term focused.

Bottom line

We’ll have to wait to see how the next two decades play out in reality. But even if returns diminish, you don’t have to stop investing. As we’ve seen even in financial crises, there’re always opportunities in a bear market.