LLC owners will always be taxed on their LLC’s profits, but reducing an LLC’s tax burden and avoiding certain taxes can, in large, depend on the structure of an LLC.

The tax burden an LLC’s profits are subjected to is influenced by its tax classification, which is in part determined by the Internal Revenue Service (IRS), but a tax designation can also be chosen by an LLC’s owner. Here we’ll have a look at how the different LLC structures are classified and taxed by the IRS, and the possible ways LLCs can reduce their tax burden.

Single-member LLC

According to llcratings.com, single-member LLCs are taxed as sole proprietorships by the IRS. An LLC’s profits are taxed by when the profit is added to the personal tax returns of LLC owners. LLC owners must file a Schedule C form on which they calculate and report the LLC’s profits and losses of the previous year. A single-member LLC’s profits are reported and added to the personal income of the LLC owner’s personal tax returns, the business profits are then taxed accordingly on a personal level.

Multi-member LLC

Multi-member LLCs are classified and taxed by the IRS as partnerships. The LLC itself does not pay tax, instead, LLC members pay taxes on their individual share of LLC’s net profit, as determined by operating agreement and usually reflected according to investor share. Each LLC member must file Schedule K-1 form, detailing their share of the profits and losses, which must also be included in their personal tax returns to the IRS, and is therefore taxed accordingly. Both single and multi-member LLCs avoid something we call double taxation, which happens when a business’ profits are twice, once on a corporate level and again on a personal level. Avoiding double taxation is a good means of reducing the tax burden a business can experience.

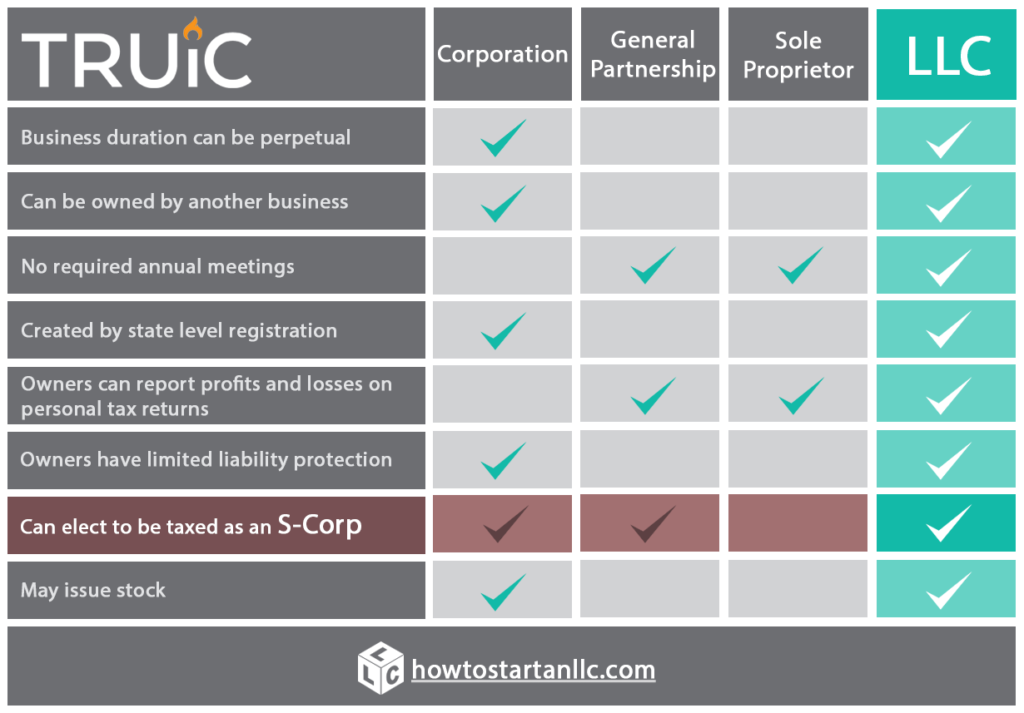

An LLC with a C-corp or S-corp tax classification

LLCs can also be classified and taxed as a corporation. This altes how LLCs are taxed and how taxing is handled. Classifying an LLC as a corporation can have favorable tax advantages and can significantly reduce tax burdens on an LLC. When an LLC is classified as a C-Corp, the LLC’s profits are taxed at a corporate level, and the LLC’s owners are also individually taxed on their share or dividends of the LLC’s profits. This is seen as a tax disadvantage as the LLC’s profits undergo double taxation. However, an LLC can also file taxes as a S-corp, even an C-corp LLC can file taxes as a S-corp LLC. According to the IRS, the profits and losses of an S-corp LLC can be passed on to its shareholders for federal taxing purposes. S-corp LLCs report their profits and losses to the IRS, but shareholders are given a Schedule K-1 form on which they report their share of profits or losses, and use the information to complete a Schedule E form to add to their personal tax returns. An S-corp LLC’s profits are thus also avoid double taxation and are only taxed once, on a personal level.

Gaining tax deductions

To sum it up, single-member, multiple-member and S-corp LLCs avoid double taxation, which is something business owners should aim for. However LLCs can also reduce their taxes by filing for tax deductions. For example, single-member LLC, treated and taxed like sole proprietorships, can file for similar tax deductions, such as healthy insurance, for owners and their dependents, or business operating expenses like vehicle and home-office expenses. However, LLCs in general are granted specifically tailored tax deductions. For example, if an LLC makes a charitable donation they are able to claim back 10% of that contribution. There are many other avenues LLCs can take to increase their tax deductions and reduce their overall tax burden, no matter the type.

When forming an LLC (whether it’s on your own, with an LLC service, or through an attorney in your state), it is important to research the tax burden a business will be faced with. Knowing which types of LLC allow for certain tax advantages and reduce an LLC’s overall tax burden, can be a deciding factor in choosing which type of LLC to form. To find out how to form an LLC, how the different LLCs are taxed, and how to choose the correct tax designation for your LLC, visit TRUiC website where more information and guidance on how to form an LLC and minimize its tax burdens.