In recent years, the average US wedding budget stretched to $35,000. Since that represents a decent chunk of many people’s annual income, it makes sense to figure out a wedding budget that works for you. You may dream of the perfect gown, the lushest floral decorations, and the ultimate destination packages. A wedding on a budget does not have to compromise on much.

The first step is to understand the typical wedding budget breakdown and plan where your money should be going to, on that special day. You must discuss with your partner on where to splurge and where to save. Below are some tips to on how to figure out your wedding budget and make it a realistic one.

Common Costs for a Beautiful Wedding

Knowing where the money goes can help you determine what you want to spend more on and where you can compromise.

- Wedding venue and catering – 35%

- Decorations and flower arrangements – 15%

- DJ, band, or other entertainment – 15%

- Photographer and videographer – 10%

- Wedding cake and favors – 10%

The remaining 15% covers transportation to and from the venue, gifts for the wedding parties, hair styling and makeup, invitations, and incidentals. Do not forget to budget for the wedding dress, bridesmaid dresses, and tuxedo rentals too.

Creating a Wedding Budget

The best way on how to figure out your wedding budget is to determine how much you can spend and then start shopping or pricing services. Falling in love with a venue or browsing celebrity-baker wedding cakes and then trying to fit the higher prices into a budget may lead to overspending.

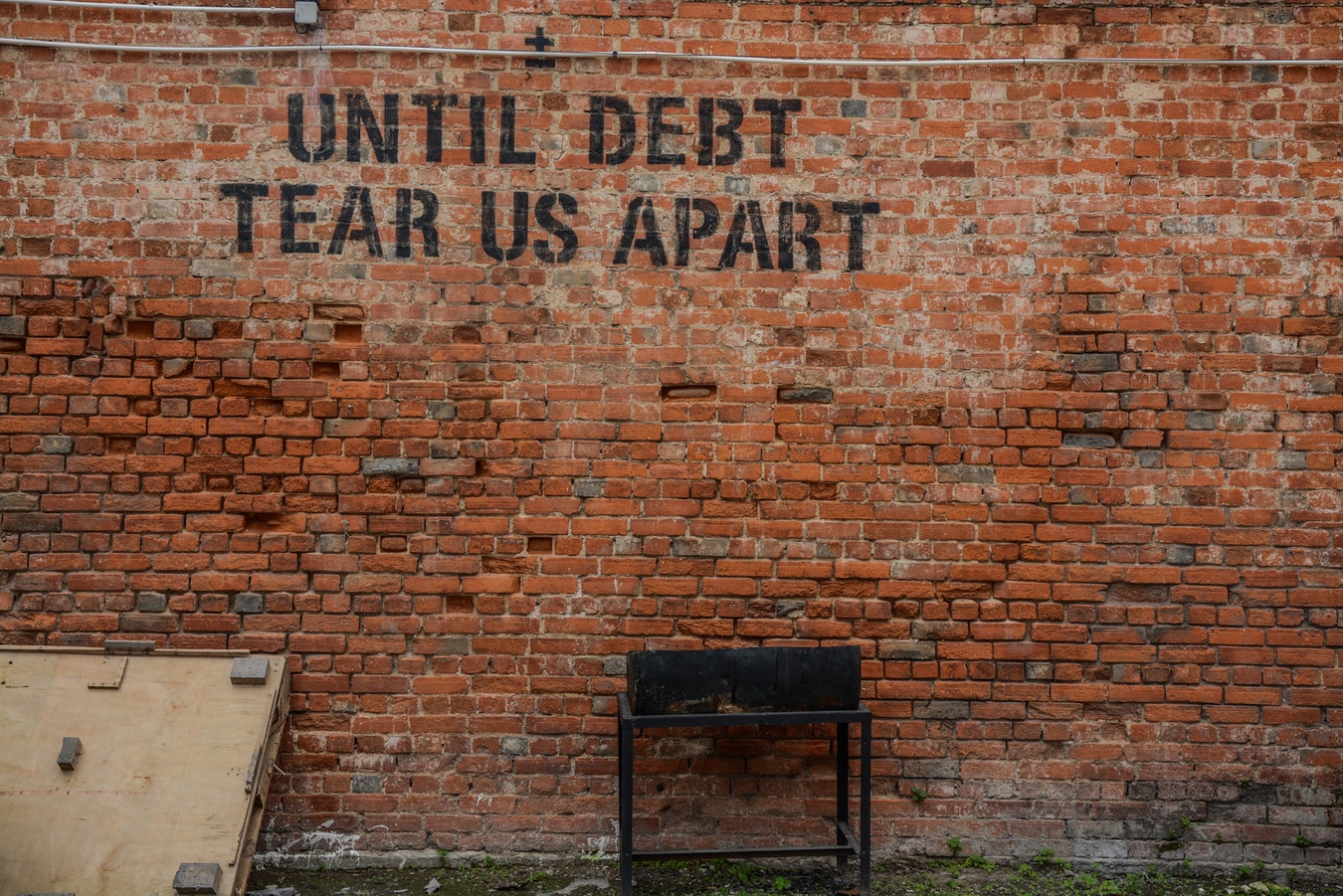

Instead, find out how much, if any, family members will contribute, how much of your savings you want to spend, and how much you are willing to put on credit. Ideally, the last item on that list should be zero. Going into debt at the start of a marriage makes little sense.

Planning wedding costs realistically helps you have a beautiful, memorable, yet low-stress day.

Determine What You Value Most

Whether you have $1000 to spend or $100,000, the bulk of the wedding budget should go to what you perceive as the most valuable part of your wedding day. For some, that may be a trip to a beautiful destination to get married on the beach. For others, the perfect princess gown tops the list. Or maybe you always dreamed of a certain band playing your favorite music at the reception.

Keep an eye on the total dollar amount you decided on and adjust other expenses accordingly. Your wedding day should be a once in a lifetime thing, and you deserve to make your biggest dream come true.

Expect to Negotiate for the Best Price

Wedding vendors may highlight set prices for different packages they offer, but negotiating different deals and choosing a la carte wedding options makes sense for many budgets. You might love a venue but do not want their decorations package. You may choose a pre-styled wedding bouquet but negotiate a lower price if you use tea roses instead of hothouse orchids.

Do not be nervous about negotiating with family or friends footing part of the bill either. Maids of Honor or Best Men usually throw and pay for bachelor and bachelorette parties, but other pre-wedding parties like for rehearsal dinners could allow for savings. Ask if your parents would pay or if they would shift the money to another expense instead.

Set Some Aside for Surprise Expenses

You want everything to go perfectly when you plan your wedding and reception. With a firm budget amount determined and a healthy dose of self-control, you may spend it quickly with venue bookings and dress fittings. To prevent headaches and potentially serious financial issues down the road, always leave some in the budget for surprises.

When it comes to budgeting for your wedding, do not let yourself get blindsided by the expenses. Your day can be as beautiful, romantic, and memorable as high-priced celebrity weddings while sticking to a responsible financial plan.